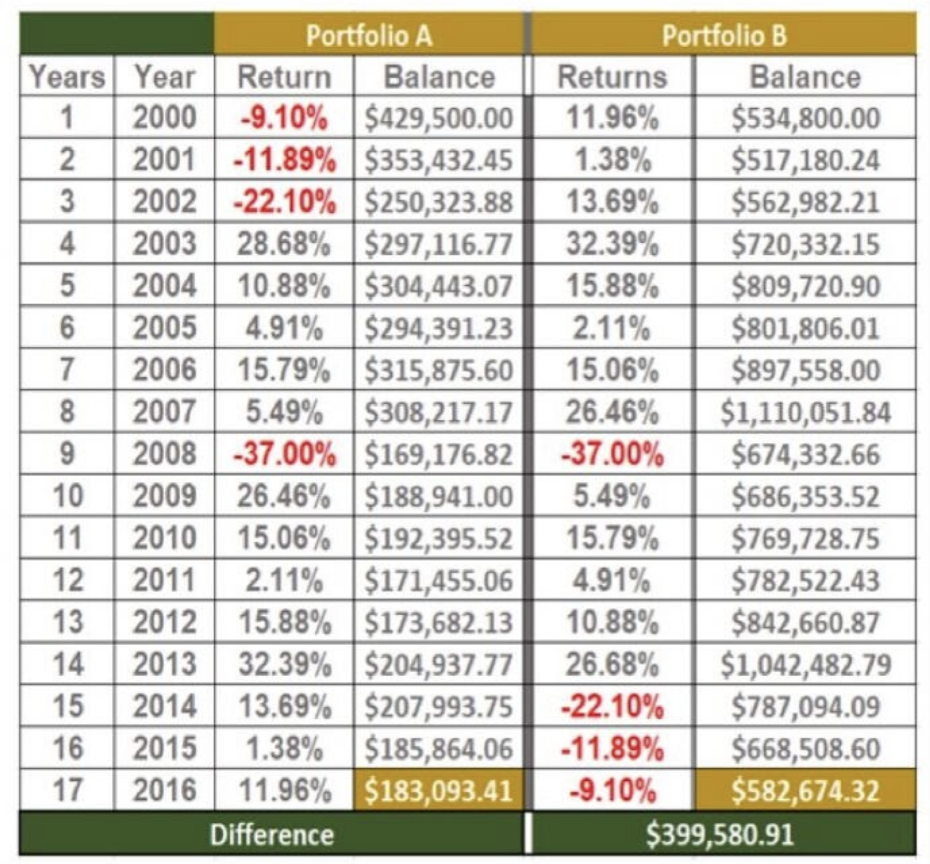

Take a look at this graph which illustrates the concept of sequence of returns. As you can see, it shows portfolio A and portfolio B. Both portfolios start with the same amount of money, and both portfolios take the exact same amount of income. The only difference is the returns are inverted. The returns on portfolio A returns run from year 1 to 16, and the returns on Portfolio B returns are inverted and go from year 16 to year 1.

The idea is that everything is the same, even the 16-year return is the same, but look at the balances! If you’re taking income from a fluctuating stock portfolio, you have to be aware that this could happen to you. Portfolio A and Portfolio B had the same percentage return. They took the same income over the same time frame, but Portfolio A’s ending balance was just over $181,000, and Portfolio B’s balance is worth over $580,000! That’s a difference of 388k!

If the market goes down in the first few years of retirement and you’re counting on these assets to last throughout your retirement, you could have a big problem. Planning is key! We provide personal financial advice that is tailored to your financial needs and goals, but first must find out what your needs and goals are, then create a plan around those needs and goals. Our Financial Advisors from Malibu, CA, have your best interests at heart.

- We are RIA Fiduciaries and experienced investment advisors that put your needs first

- We aim to maintain long-term relationships with clients

- We provide impartial and straight-forward advice

- The investment strategies our stock market investment advisors create are built around your goals and needs

Not only that, our financial investment advisors from Malibu, CA, recognize that a one-to-one relationship is not only about money management but an ongoing financial strategy that gives you peace of mind and the financial ability to pursue your life goals.